Question 1:

Why do Chinese save so much? Why does it matter?

There are a number of theories set forth as to why Chinese normally save so much. Some of the reasons provided relate to their precautionary motivates, uncertainly of changing times and their general anxiety over the costs of old age pension, education, and healthcare. However, the real reason why they save so much is related a social phenomenon. For years, China has had a considerable imbalance between numbers of female and male children born the citizens. There are about 122 boys conceived for every hundred girls, the ratio which translates to cutting around 1 in 5 Chinese men from the marriage market once such a generation matures. As such, the resulting pressure in this marriage market forces men, as well as, parents with male children to do what would be in a position of giving them a competitive edge. Incrementing the saving, via cutting down on a family’s expenditure is one of the means they resort to.

Question 2:

What was the role of the US government and US central bank in the house price boom of the 2000.s?

Both the Us government and the US central bank played a role in the house price boom of the 2000s. On one hand, the government housing policies, failed regulation, deregulation and over-regulation led to the financial crisis. The government implemented and repealed several laws which restricted the regulation of banking and financial sector, such as the Glass Steagall Act repealing, as well as, the implementation of the 2000 Act of Commodity future modernization. The former permitted investment and depository banks merge, whist the later restricted the regulation of the financial derivatives. In effect, the U.S non-depository system expanded to surpass the rather regulated depository system size but the insurers, investment banks money market funds and hedge funds were not subjected to similar regulations. Such institutions suffered the same fate as the bank run with notable collapses being that of AIG and Lehman Brothers precipitating the housing price boom.

On the other hand, the US central Bank’s loose monetary stance particularly in the 200s fuelled the housing bubble to a large extent. From 2004-2006, the federal reserve raised the interest rates about 17 times, thereby incrementing them from 1 percentage to 5.25 percent before pausing. This raised the interest rates due to the concern that the accelerating down-turn in housing market would undermine the entire economy.

Question 3:

Is there (or was there recently) a housing bubble in your home country? Try to

and some data or graphs to illustrate your claim. Did the government and/or central bank of your country play any particular role in that respect?

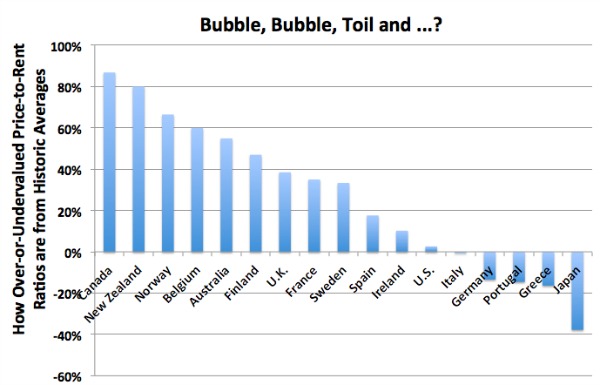

Back home in Australia, there is a housing bubble. To some extent, the government and the central bank are to blame for this crisis. The government has encouraged private sectors to lever up thereby making bad loans in housing sector. The Australian reserve bank on the other hand has permitted the other financial institutions to create too much money through loans. In effect, the Chinese appetite for Melbourne and Sydney real estate has already caused the prices of house to surge in the country at a rapid pace. According to the recent data, prices of house in Sydney have rose at an untenable 15.6 % year on year. This is closely followed by Melbourne’s 11.6 %. The two cities have left Australia in financial crisis, by helping push up a combined capital by around 10.6 %. It is rather unfortunate that, with such a bubble in the offing, both the reserve bank and the Australian government are sitting back, neither of them desiring to take the blame for anything that will tilt the increasingly unstable system, sinking Australia into the housing price bubble. In comparison to other nations, Australia has ratio of 58 per cent in respect to how under-overvalued price to rent is in history

References:

|

Grammar

D

|

Formatting

D

|

Organization

D

|

Style

F

|