Perfect competition is often known as pure competition. It falls under the economic theory because its description of the market is such that none of the participants can have the market power. Consequently, the participants cannot set the price of the homogeneous products. Moreover, perfect competition operates under strict conditions. These conditions can be limited in cases whereby there is a perfect competitive market. However, some sellers and buyers under the auction-type market argue that financial assets and products can approximate this concept. The perfect competition is a natural benchmark when compared to other structures in the market. Therefore, it is a Pareto efficient economic resource (Baumol 111). This market also operates under some assumption for it to be successful. In summary, perfect competition is efficient and causes firms to benefit in the short-term. However, buyers are likely to benefit significantly in the long-run since they obtain products at low prices.

The efficiency of the perfect competition is that market has scarce resources which provide a perfect market condition that can be highly competitive. Consequently, every firm needs to exercise efficiency under right market conditions. Additionally, perfect competition highly assumes the market structure to be strong, and exists in the real market (Mas-Colell 531). As a result, this means that the reality is that most of the market is highly about imperfect competition. Arguably, there has to be assumptions to cater for the short-term and long-term efficiently goals for the market to be perfect.

The first assumption is about homogeneity of products. In this case, the products under sale by a seller in the market are identical to the ones under sale by a supplier. Arguably, buyers hardly worry about supply sources as long as the products are of the same price and are identical.

Another assumption is about perfect competition. In this case, firms take note of the price. This means that the firms have the power to alter the output without altering prices of products in the market (Mas-Colell 533). Notably, sellers and buyers can be few compared to the expected market capacity hence do not have the power to alter market prices of products. As a result, the buyers and sellers accept the product prices that are in the market.

The third assumption is that the buyers are well knowledgeable regarding products and their characteristics as charged by each firm (Hunt 56). This is because sellers and buyers are required to understand the economic data and technologies used by firms. Therefore, there should be a substitution from the affected firm if it changes the price of a product.

The fourth assumption is that there are no barriers that exist in the market. Therefore, a supplier can get in and out of the market. This eventually affects the profits of a firm in the end. The final assumption is that firms equally can access the resources and technologies (Roberts 837-841). This means that firms cannot consume anything outside the market.

The demand curve is elastic under a perfect market condition. In such a market, the respective marginal cost must be equal to costs of production leading to equilibrium. This is due to the increase in many factors of production. For example, a firm must increase employment cost in order to increase its production capacity.

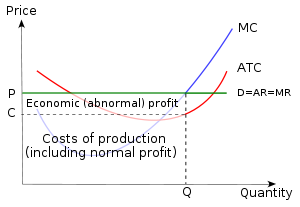

In the short-term, an individual firm can make economics gains as depicted in the diagram above. In this case, average revenue or the price, denoted by P, appears above average costs as depicted by C.

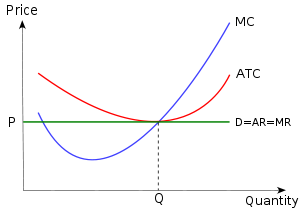

In the long-term, the economic profits become less-sustainable. In this case, new firms arrival or expansion regarding existing firms within the market can cause horizontal demand curves for each individual firm to shift downwards. In turn, this brings down the price (Kreps 22). Similarly, the average and marginal revenue curves undergo the same processes. According to long-term projections, the firm is likely to achieve normal profit only. This is an indication of zero economic profit. As a result, the horizontal demand curve can only intersect with the average total costs curv e at the lowest point.

In conclusion, the perfect competition market is efficient and can be profitable for the firms in the short term. However, in consideration of long-term projections, firms only make normal profits. Moreover, the assumptions in the market are only theoretical because the real market is not fully perfect. On the other hand, the perfect market is beneficial to consumers in the long-run. This is because they can get products at the lowest prices in the market. In summary, perfect competition is efficient and causes firms to benefit in short-term while in the long-term buyers benefit because they get products at the lowest prices.

Works Cited

Baumol, William. Regulation Misled by Misread Theory: Perfect Competition and Competition-Imposed Price Discrimination. New York: Amazon Publishers, 2004. Print

Hunt, Shelby. Marketing Theory: Foundations, Controversy, and Strategy. London: M.E. Sharpe, 2010. Print

Kreps, David. M. Course in Microeconomic Theory. New York: Harvester Wheatsheaf, 1990. Print

Mas-Colell, Andreu. Non-cooperative Approaches to the Theory of Perfect Competition (Economic theory, econometrics, and mathematical). New York: Petra Gros, 1982, Print.

Roberts, James. “Perfectly and imperfectly competitive markets.” The New Palgrave: A Dictionary of Economics 1987: 837–841, Print

|

Grammar

D

|

Formatting

B

|

Organization

D

|

Style

F

|