Task: Prepare a detailed analysis of the Goodyear Tire & Rubber Company (GT)

Essay Topic: The Goodyear Tire & Rubber Company (GT)

Essay Type: Coursework

Length: 1 page

Formatting: MLA

Requirements: Provide a full report on the activities of the Goodyear Tire & Rubber Company (GT). Provide the supporting visuals. Compare the activities of the Goodyear Tire & Rubber Company (GT) with its competitors’ activities.

Plagiarism

100%

unique text

- The beta of The Goodyear & Tire Rubber Company is 2.05. Beta measures how sensitive a stock is to fluctuations in market returns. When the value of beta is greater than 1, this suggests that the returns of the associated stock have more volatility than the returns on the market index, while a beta below 1 suggests that a stock’s returns have lower volatility than those of market index. The Goodyear Tire & Rubber Company beta of 2 signifies that the returns on the firm’s stock are very volatile relative to market returns. The high beta of the company means that the firm has high systematic risk and, therefore, higher returns are required on the stock to compensate for this risk. During economic booms The Goodyear Tire & Rubber Company stock is likely to post very high returns while in recessions it is likely to register very low returns because of its high beta.

- Overall, the price of The Goodyear Tire & Rubber Company stock has been increasing in the past five years. The current price of the stock is $24.58 relative to its price of $18 in late 2009. However, the price was on a declining trend between 2010 and 2011. It fluctuated without definite trend between 2011 and the early part of 2013 before finally picking an upward trend in 2013. This trend has been sustained up to now. The latest trend of the company’s share price seems to be driven by the current upbeat state of the American economy and the world economy as a whole, as opposed to good prospects of the company itself.

- a) P/E Ratio

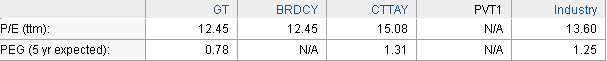

The Goodyear Tire & Rubber Company price-earnings ratio is 12.45. Bridgestone Corporation and Continental AG, which form part of its main competition, have a P/E ratio of 12.45 and 15.08, respectively. The average P/E for the industry is 12.64. Based on P/E ratio alone, the stock of The Goodyear Tire & Rubber Company would seem to be correctly priced because its P/E ratio does not differ substantially from the average for the industry. However, price-earnings ratio does not consider the growth characteristic of earnings which is an important factor when valuing companies. Companies with higher earnings growth should have a high share price than companies with lower earnings growth but which have the same price-to-earnings ratio. The growth characteristic of earnings is captured by the price/earnings to growth ratio (PEG).b) PEG Ratio

The Goodyear Tire & Rubber Company has a PEG ratio of 0.78. Its competitor Continental AG, on the other hand, has a 1.31 PEG ratio. The industrial average on this ratio is 1.25. The PEG ratio indicates that the stock of The Goodyear Tire & Rubber Company is undervalued since it has a PEG ratio that is substantially below the industrial average. The PEG ratio of its competitor Continental AG, in contrast, suggests the stock of that company is overvalued. - Stock Market Condition

The stock market seems to be on a downtrend currently as evidenced by the decline of the values of various indices. For instance, the S&P 500 lost 2.7% in value the previous week. This decline can be attributed to negative economic outlook and future uncertainty about the direction of monetary policy. Investors expect the Fed to increase interest rates if inflation threatens and unemployment continues to fall. However, unemployment is still high and, therefore, the Fed is likely to keep interest rate hike on hold in the near future. Thus, the markets are likely to rebound from the current decline.

Fig. 1: The Goodyear Tire & Rubber Company Share price Trend in the Last 5 Years

Fig. 2: P/E and PEG of GT and Competitors

Assessment

Overall Impression:

“

This paper is decent, though the author made a number of annoying mistakes.”

|

Grammar

C

|

Formatting

D

|

Organization

B

|

Style

B

|